Good afternoon subscribers!

Today we are using the Monday Write Up to preview one of the data updates we are working to make a regular weekly post on our substack - regional power data for notable areas. In today’s update we are showing data for January and February 2025 in the RGGI area (for more information on RGGI, click here).

Upcoming Data Releases:

Wednesday March 5, 2025: EIA Weekly Petroleum Status Report will close out the February Releases

RGGI Market Update

(NOTE: The data here includes all of PJM markets, which means it includes Pennsylvania which is still in limbo with regards to joining RGGI)

RGGI is one of the largest cap-and-trade (and the first!) programs in the US and covers states in the North East. As the program continues to lower it’s annual allowance cap, we are watching the participating states’ ability to lower their use of emitting fuel sources in the power market.

January and February 2025

While we hope to regularly post this information on a monthly basis, we are working with January and February 2025 since it is our first time sharing this information this year.

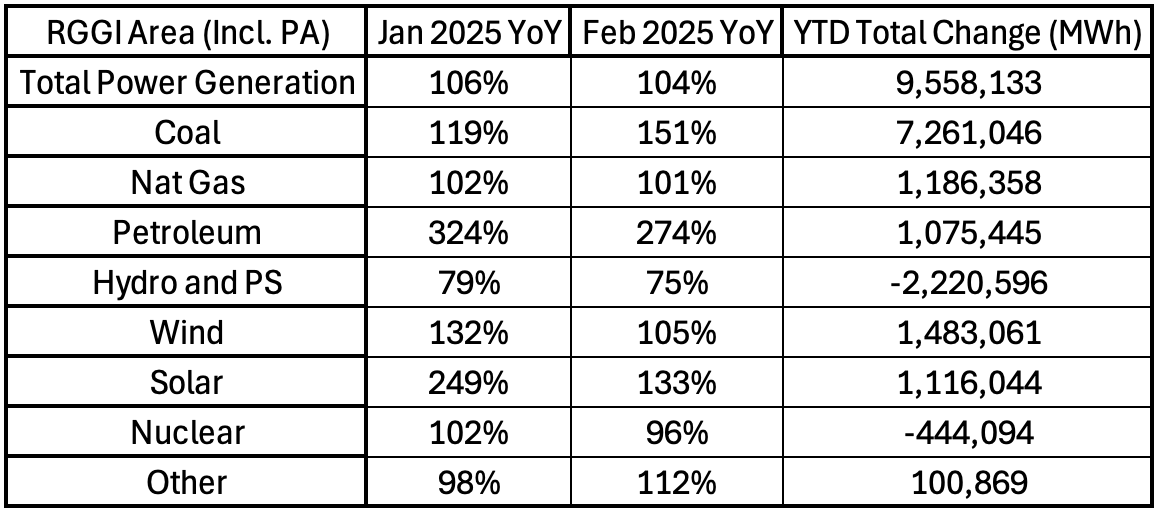

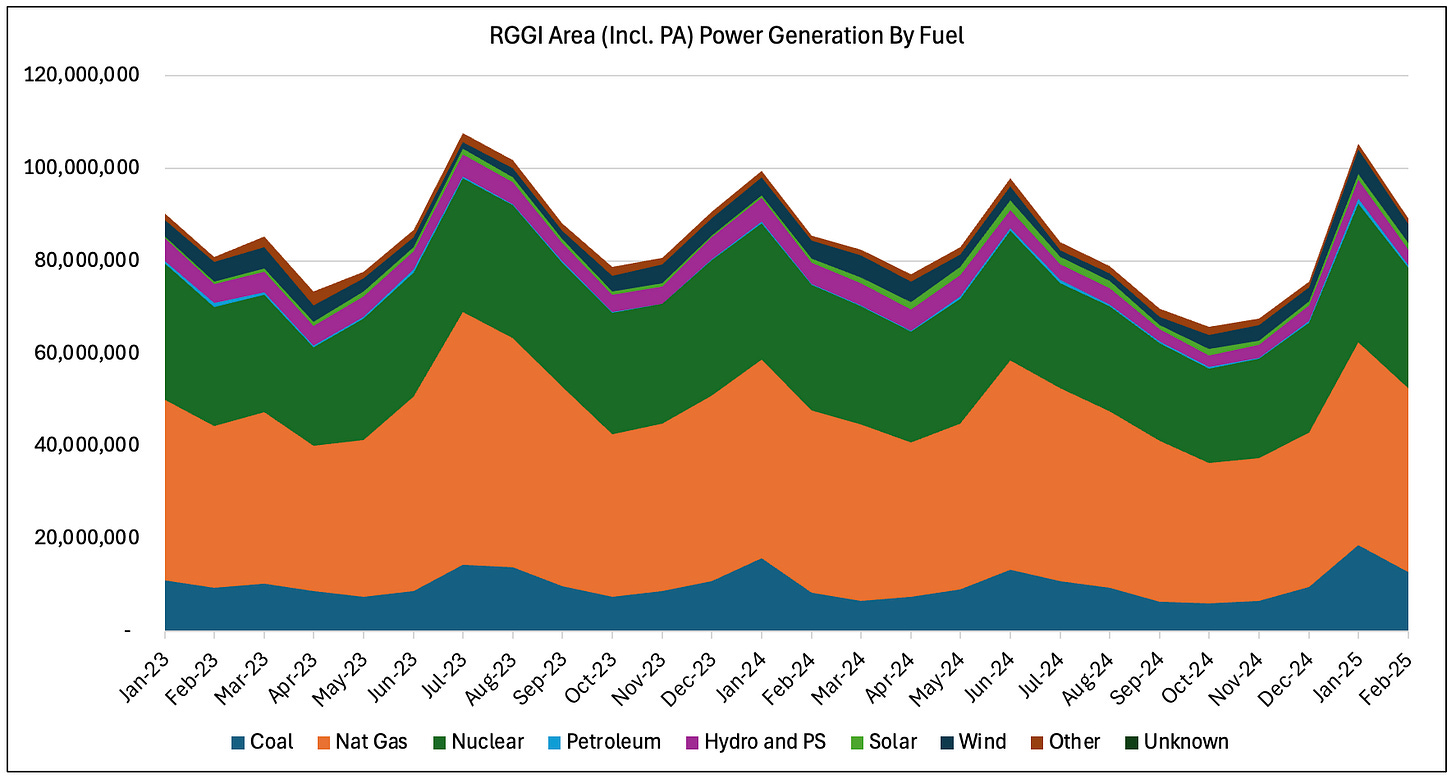

Much like 2024, the first 2 months of the year saw a year on year increase in power generation and a larger share of generation coming from the carbon emitting fuel sources (coal, natural gas, and petroleum products).

The lion’s share of the increase in MWh can be attributed to coal, which is dominant in non RGGI states in PJM, but we would be remiss not to point out that the growth was seen across the board in nat gas, coal and petroleum use through the whole region with the exception of 836 GWh (836,000 MWh) in January 2025 YoY for New England. Excluding PJM entirely, the New York and New England ISO’s saw an 891 GWh increase in these fuels over the period against last year.

This trend is a continuation of last January and February, which also saw similar growth over 2023. There are a few things to watch as we see this trend - the first is that we are seeing a bigger reliance on the emitting fuel sources during higher demand time periods and the other is that, as Pennsylvania continues to battle out joining RGGI fully or not, this could have a massive impact on allowance demand.

Another thing to note, however, is that last year saw a decrease in the total emission creating technologies as the year went on - in other words, its far too early to make any calls. But if weather cools off dramatically before winter is out or if summer is particularly harsh, we could see a net increase in power consumption across the region.

With the program review still underway, the fundamentals remain subject to shift with each update. We will continue watching the data and hope it can continue to give us insight into what the year’s demand will look like.