Regional Greenhouse Gas Initiative (RGGI) Primer

Everything you need to know about the RGGI program to get started

What is the Regional Greenhouse Gas Initiative?

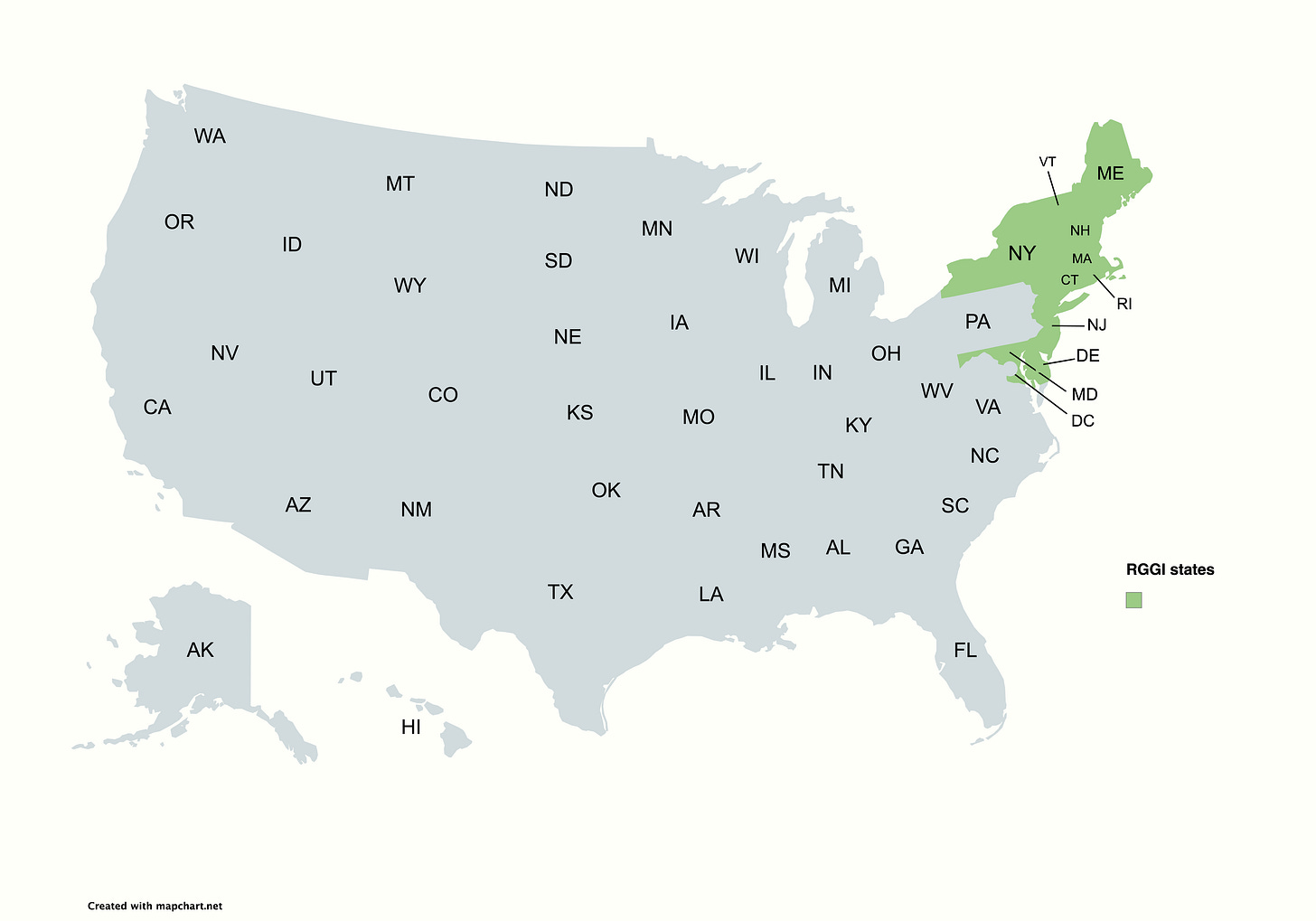

The Regional Greenhouse Gas Initiative (RGGI) is a market-based cap-and-trade program designed to reduce carbon dioxide (CO₂) emissions from the power sector in participating U.S. states. Launched in 2009, RGGI was the first mandatory cap-and-trade program in the U.S. aimed at cutting greenhouse gas emissions. The initiative includes 12 states, with 10 active participants: Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, Virginia (until its planned withdrawal in 2024), and Pennsylvania (pending full participation).

Under RGGI, participating states set a regional cap on CO₂ emissions from power plants. Power companies must purchase emission allowances through quarterly auctions, with each allowance representing one ton of CO₂. The cap is gradually reduced over time, ensuring emissions decline. Revenue from the program is invested in clean energy, energy efficiency, and consumer benefits, such as rebates and low-income assistance programs.

Since its launch, RGGI has successfully lowered emissions, raised billions in revenue for clean energy investments, and boosted economic growth in participating states. The program has also served as a model for other cap-and-trade initiatives, influencing policies at state, national, and international levels.

History of the regional greenhouse gas initiative

The Regional Greenhouse Gas Initiative (RGGI) is the first mandatory cap-and-trade program in the U.S. designed to reduce carbon dioxide (CO₂) emissions from the power sector. Its origins trace back to 2003, when then-New York Governor George Pataki invited Northeast and Mid-Atlantic states to develop a regional emissions reduction program. By 2005, seven states—Connecticut, Delaware, Maine, New Hampshire, New Jersey, New York, and Vermont—signed a Memorandum of Understanding (MOU) to create a cap-and-trade system, with Massachusetts, Maryland, and Rhode Island joining soon after.

RGGI officially launched in 2009, with the first CO₂ allowance auction held that same year. The program set an initial emissions cap, requiring power plants to purchase allowances for every ton of CO₂ emitted. The revenue generated from these auctions was invested in energy efficiency, renewable energy, and consumer programs.

Over the years, RGGI has expanded and evolved. New Jersey briefly withdrew in 2012 under Governor Chris Christie but rejoined in 2020. Virginia joined in 2021 but later announced plans to exit in 2024. Pennsylvania’s participation remains uncertain due to legal and political challenges. In 2017, RGGI states agreed to a 30% emissions cap reduction by 2030, strengthening the program’s impact.

RGGI has been highly successful, contributing to a 50% reduction in power sector CO₂ emissions since 2009, raising billions of dollars for clean energy programs, and serving as a model for other carbon pricing initiatives, including California’s Cap-and-Trade Program and, potentially, national policies.

How does RGGI work?

RGGI is overseen by a non profit called RGGI, Inc. that provides administrative and technical services. However, the program itself is implemented by state agencies responsible for energy and environmental regulation. Each state has a cap that it provides for its utilities and electricity providers. The regional cap for all RGGI states (adjusted for states that have left and joined) can be seen in the table below.

There are 4 auctions a year in which obligated parties can purchase these allowances. In 2025 the auctions will take place on:

March 12, 2025

June 4, 2025

September 3, 2025

December 3, 2025

Each auction will allow obligated parties to purchase some allowances. Once all the allowances in a given auction are purchased, there is an emergency pool of allowances that are unlocked at whats called the Cost Containment Reserve (CCR). The cost containment reserve unlocks an additional 10 percent of that year’s RGGI Cap. Similar to the California Cap-and-Trade (Primer for that can be found here), is the compliance periods. In RGGI these are called control periods and can be seen below.

Also, similar to the California cap and trade, there are two type of compliance obligations

Interim Compliance Period Obligation: 50 percent of all obligations need to be submitted by March of the year after each calendar year that is not the final year of a control period.

Total Compliance Period Obligation: by March following the final year of the control period, an entity needs to cover all emissions that remain from the entire control period.

For example for the 2024 interim compliance period, December 4, 2024 will be the last auction, January 30, 2025 will be when data is reported, and March 3, 2025 is when 50% of 2024’s emissions worth of allowances have to be submitted for compliance.

RGGI Prices

Below is a chart of RGGI prices. In 2024, the RGGI market saw a spike in prices. The likeliest reason is strong demand in the auctions amidst concerns that future allowances will not be able to cover the interim year and control period, resulting in a drawing down of the allowance bank. As a result, the CCR was triggered and completely depleted in the first auction (March of 2024). Strong demand continued until a potential program update was released, stating that there could be 2 CCR’s for each interim period 2027 onwards.

The market will continue to monitor the program review since it is ongoing and will have major implications for the fundamental outlook of RGGI allowances going forward. In the short term, demand continues to be at strong levels amidst increased electricity usage in the RGGI states while supply shrinks every year.

Participants in the RGGI Market

The auction and secondary allowance markets for RGGI are dominated by utilities, power generators, power traders, and some trade houses. For a wider pool of participants, there are also funds and other traders utilizing futures contracts on both ICE and Nodal exchanges that have seen liquidity growing significantly over the past year. Finally, Kraneshares includes RGGI allowances as part of the basket in it’s Global Carbon Strategy ETF, ticker KRBN.